Why it is so Difficult to Let Winning Stock Picks Run to Big Gains?

There are 2 situations as an investor where I tend to get antsy, especially when picking individual stocks. First, if I have a big loss. This might happen because of a bad earnings report. The stock, suddenly, is down 20-30% and the whole thesis for the company is in question. In that situation, it's gut check time. If I have good reason to think other investors are wrong for selling, I can add more -- but adding to a losing position might just create a bigger loss. If I'm not sure why it's down, I might just sell and move on. Not every pick will win.

I'm ok with taking losses. It's normal, and a small loss is better than a big loss.

The second antsy situation is more fun: what to do with a big gain.

In 2020, I had this situation with Moderna. It was a hot, unproven vaccine play and by dumb luck I'd had an investment dating back to May 2019, pre-pandemic. I was up 100% then 200% then 300%. So I sold 1/3, then another 1/3, then let the rest go. Turns out I could've held it all but I didn't know that at the time. The vaccine actually worked. I've bought a little back. MRNA could be overvalued but they will not be going back to the days of unproven. They now have a billion dollar product for a disease that is not going away, and more products in the pipeline.

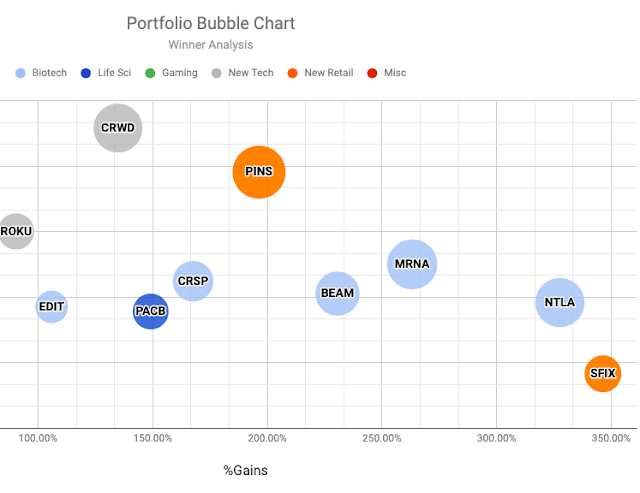

Ok, so now I have a number of positions that are up between 100-350%. Not complaining; the point of this post is to actually figure out how to think about big gains and what to do next.

WHY IS LETTING WINNERS RUN SO DIFFICULT?

This is the core question. Why is it so difficult to hold onto stocks that are up big? My gut reaction looking at my portfolio is to take profits and find new investments, or add to positions that are not up so much. I hear some of this same advice on CNBC -- rotate out of big winners and into beaten down stocks. Why do we think this way?

Well, for me personally, I remember the Dot Com Bubble. I saw people making a lot of money so I opened a brokerage account and bought shares of Gap. Not even an internet stock, I was not very good at this game. But, Gap was hot, selling khakis and promoting swing dancing. That would go on forever, right? I called the broker and bought a few shares with $15 commission.

Here's the Gap chart.

It's amazing to see that bubble, even a retail clothing company went up 300%. Also amazing to see how long the bubble went on. People started talking bubble in 1996 or so, and fun old Gap went almost straight up for 3 years. 3 years!

I had no idea what I was doing, I watched it go way up, I bragged about it a little, then I watched it crash, forgot about it, and eventually sold it to get half my investment back.

And THAT is why people sell big winners. They don't want to lose.

It's also why I've never had a stock with 300% gains until this year. I have always sold, taken my 30% gain, and moved on. Or, I have bought put options to hedge my portfolio, and I watch them expire worthless. Until this year, my stock picking portfolio has been conservative and gains have been modest (understatement). I have khakis to thank for this mindset. It's the other side of the coin.

This year I've been fighting that mentality by letting winners run. This is not to say that winners will go up forever. They won't. That said, not every stock will be Gap circa 1999. Bubbles are not as easy to call as they seem in retrospect. Some stocks will soar and will keep going.

Another story. After the housing bubble, I was continually bearish. I kept expecting another crash. I read Hussman, who showed me all the economic math. Thus, another reason people sell winners: the macro economy. If macroeconomic conditions are bad, risk is high, the market will sell off and winners will suffer. So for several years I built cash and bought puts and my stock portfolio became some sort of grizzled commentary on the national debt. This got me nowhere.

MY CHANGE IN 2020

In 2020 I had plenty of cash to invest during the crash. Fortunately, I recognized past behavior and decided to pull a George Costanza. Do the opposite. It didn't work before, why would it work now?

The new plan:

Don't: sell winners, buy losers, become an economist, rotate to beaten down sectors

Do: hold winners, sell losers, become interested in good companies and ideas, stay with secular trends

Any winning stock will eventually achieve a high valuation that is not necessarily a bubble. When Google had its IPO, people were talking bubble on day 1. You could've bought Google anytime that year and be up 3,000% today. But you will only ever be up 3,000% if you hold onto some shares.

And this, I think, is the goal of the portfolio. To find those long term winners, companies that are tapping into a secular trend, innovating, and executing well. These long term winners can be wealth builders. If I'm not investing for wealth building, then I'm sort of just playing trader -- a game where most people lose.

GETTING PRACTICAL

Of course, as someone who doesn't have unlimited capital, I need to make some practical choices. Do I take partial gains as a safety measure? Do I try to trade around core positions? Do I sit and do nothing, waiting for people to stop buying khakis?

What I've been doing over the past year is focusing more on specific companies and trying to ignore macro signals. If we're in a bubble, it could go on for another 2 years, and I've proven my inability to anticipate such things. Therefore, I think the practical answer is to wait and see.

Let's take an example: ROKU.

ROKU is up 100% since October. Secular trend is cord cutting. Roku is innovating, executing, growing.

I have a small position in ROKU. If I sell now, let's say I book a $2000 gain in an IRA. Great. That's nice. But then I have a problem. I then have $4000 in cash earning no interest and sitting there. I'll probably want to make a new stock pick, looking for another secular trend innovator executor grower. I'll need to find another ROKU! Which is what I'd done before. Difficult to do, this is.

Ok, instead of selling it all, say I take half the gains. I book $1000 -- again, pretty good. Now I have $2000 to deploy. I could get cute and buy ROKU lower, if I think it's too high right now. So maybe I sell at $420 and buy it back at $340, maybe 20% lower. So I'm still invested in ROKU, just at lower prices.

The problem with this is that there's no guarantee it will go lower, and after all this buying and selling, the actual gain I've booked is becoming miniscule. And psychologically, it's difficult to buy a stock back at lower prices because there will be articles and reports about why it went lower, raising doubts. Likely, I'll start to lose money. I've then turned a winning position, initially bought in the $200s, into a dicey position.

All of this is not wealth building behavior.

Final thought. This commentary is based on my personal biases. I recognize that I am by nature skeptical and risk averse when it comes to stocks. Therefore, I need to correct for these biases. Some people have a lot more risk at play in the stock market, with huge positions that they can't afford to lose, and another crash would cripple them financially. That's not me. I can afford to let winners run, and that's what I should do, while reserving the right to change my mind if circumstances change.

Comments

Post a Comment

Reader thoughts welcome.