Technology Is No Longer A Sector

I'm finding this to be a very difficult phase in the stock market. The rally is churning between S&P 2800-2950. On a daily basis stocks are gyrating up and down but the net effect for the indices is a nothing burger for nearly a month. My option hedges did not work very well because I've been anticipating a move up or down rather than a sideways grind. For the most part options are a loser's game unless you're a math whiz or professional trader. If all this makes no sense to you -- it's for the best, carry on.

Probably a good lesson for the future is to hedge by building cash rather than buying options, which suffer from time decay in a stagnant market. Cash is great when you're uncertain and doesn't hurt you if markets sit.

Ugly Valuations

Overall equity valuations are nose bleed. Apple has a 1.34 Trillion dollar market cap with a P/E of 24 and flat to negative revenue and earnings growth. I don't think a company that size can grow at a rate to justify those valuations, especially with 20+ million unemployed Americans who will not be looking to upgrade their iPhones.

It's very reasonable to ask why the S&P 500 should be at the same price it was last October when there was no pandemic, low unemployment, and better growth prospects? Well, the difference is Fed intervention. Last October, there was not a multi-Trillion dollar liquidity injection coupled with direct payments to citizens. The Fed has offset low growth with higher debt / more liquidity. They are not allowing markets to reach distressed levels (nod to the blog A Wealth Of Common Sense -- What Happens When Distressed Markets Don't Give You Distressed Prices).

Underneath the hood, certain stocks are making big moves, especially cloud enabling tech and internet retail. I've been reluctant to chase because they are waayyy up, but here too is a good lesson. Stocks that are doing well often continue to do well (because growth), while stocks that stink often continue to stink (because they stink). If you want to catch an uptrend, you can buy a small position and add to it later on dips -- you need, of course, to believe in the investment thesis despite price volatility.

Impossible to say what happens next. We could crash again or we could be in another bubble.

Tech Is An Essential Growth Area For Business

What I have been trying to do is avoid picking a side; instead I want to pick stocks that will not go bust on the way down and will outperform on the way up.

It's about identifying secular growth trends. The volatile market is anticipating winners and losers, and sometimes winners are staring us all in the face. The pandemic is accelerating trends that were already in place. 2020 is about tech becoming essential to business. In the context of a generation-defining pandemic, technology is the difference between thriving and going bust. It's the new reality. The dot com bubble anticipated this but it was too soon. Now, the reality is here.

I think a potential mistake investors could make is to think of tech as a sector and compare it to other market sectors (transportation, banking, energy, etc). Tech is no longer one part of the market, it's part of every market. What business can operate (successfully) without an increased focus on the internet, software, communications, and records management? Not many, at least when it comes to large public companies. Companies NEED to invest in technology.

Conversely, one can now imagine businesses that do not invest in travel, transportation, new buildings, and so on. Those are areas where costs can be cut. Why buy a huge office building when a dispersed team can work from anywhere? Why fly to London when you can Zoom instantly? Companies are going to invest in these trends.

This may seem obvious; I'm surely late to this realization. That's ok. In 2030, we will look back and this will be an even more obvious no-brainer.

New Tech

Don't get me wrong, value stocks and many traditional businesses can still do well. I'm going to hold my energy stocks because I bought at low prices and they are working. But, I can no longer ignore what I'm calling "new tech."

Some investable and non-investable trends:

- There will be more and more e-commerce, less and less physical retail. Buy companies that enable e-commerce, avoid traditional brick and mortar.

- There will be more work from any location, less work from big office buildings. Buy remote work infrastructure, avoid certain REITs (shopping malls).

- There will be less travel and smaller crowds for a long while. This may snap back quickly to a degree but not to pre-pandemic levels. Avoid companies that depend on travel and crowds.

- There will be more focus on innovative biotech / medical service companies for a long while. Buy those.

I've already made some moves in this area.

Portfolio Update

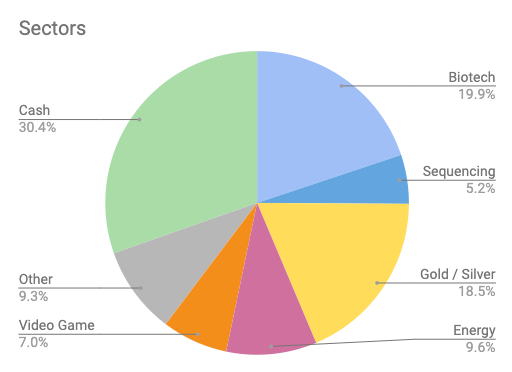

As of today, my portfolio looks like this:

The decreases in each sector are mostly due to the fact that I added a lot of cash to the portfolio, both by contributing money and by selling shares. My largest holdings are still Biotech and Metals. MRNA is still flying, and Gold Miners hit new highs this week. Next is Video Games, where I've increased my positions (ATVI had an outstanding quarter).

I've already added New Tech, mostly in cloud based identity management (OKTA) and cyber security (CRWD), and smaller positions in advertising and retail (TTD, SFIX). I renamed Sequencing to Life Science Tools, and I broke out Cannabis from Other. This is all housekeeping and not terribly interesting, but I like the look of my current graph much better. This is the portfolio I want for the current environment, along with plenty of cash to add.

In late April, my portfolio looked like this:

Comments

Post a Comment

Reader thoughts welcome.